Mid-Term Management Plan

Sixth Mid-Term Management Plan

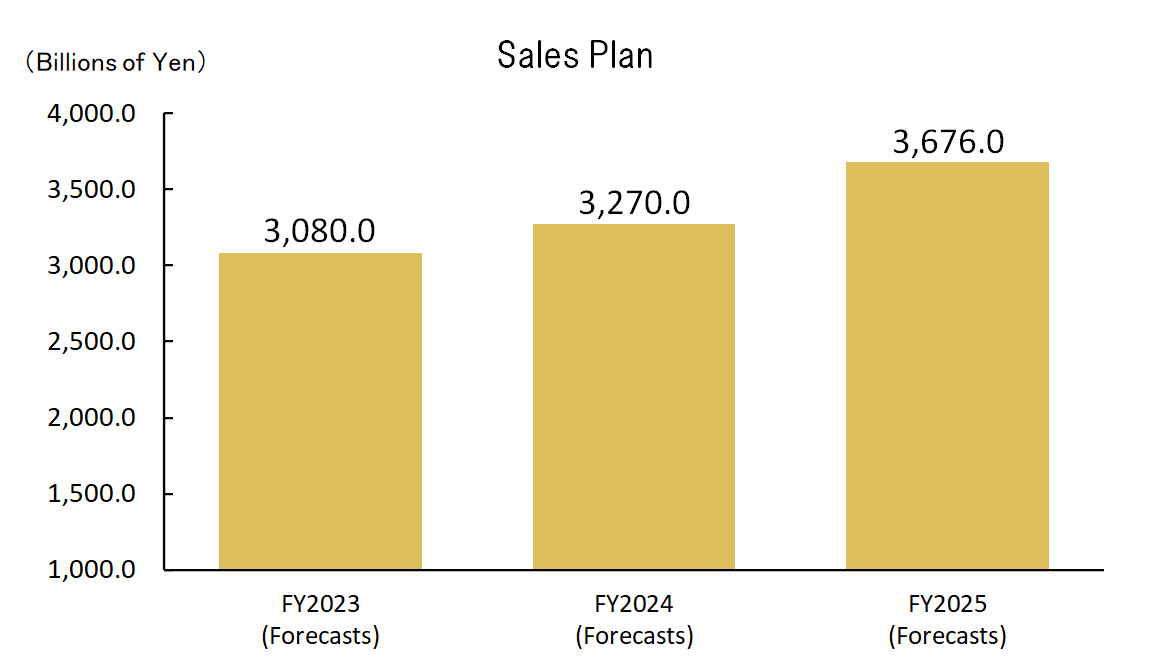

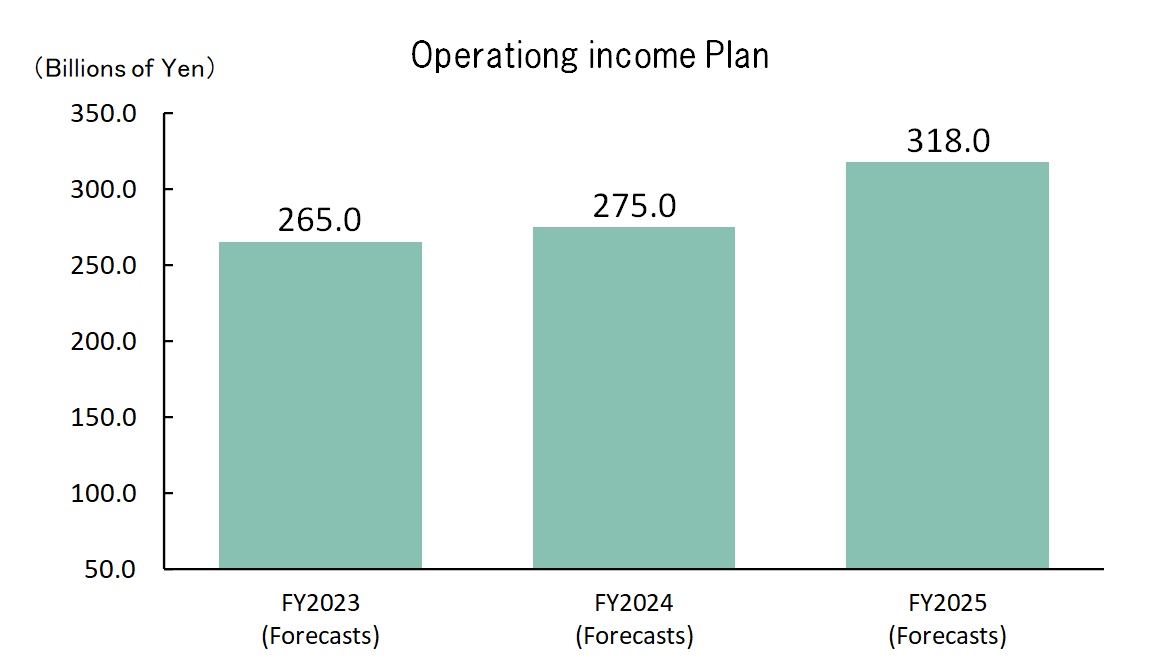

Sekisui House formulated its Sixth Mid-Term Management Plan in March 2023, with FY2025 as the plan's final fiscal year. Please refer to the financial results for latest year. (The financial results by fiscal year can be found here.)

Change in Business Results

*As of March 9, 2023

Overview of the Sixth Mid-Term Management Plan

Sekisui House has set “stable growth in Japan and proactive growth overseas” as the basic direction of its Sixth mid-term management plan, based on its global vision of "making home the happiest place in the world."

Specifically, the Group will strive to deepen and expand its existing businesses by taking full advantage of its core competencies, namely, technical capabilities, construction capabilities and the customer base. We will also leverage our unique value chain, supported by Sekisui House Group companies that together handle the entirety of housing construction processes ranging from product and technological development, sales, design and construction to after-sales services.

At the same time, we will pursue business development overseas by transferring Sekisui House technologies cultivated in Japan. Furthermore, we will keep ourselves abreast of changes in society and the business environment while leveraging digital technologies. In these ways, we will develop and expand new businesses.

In addition, we will strive to increase the value of the Group’s human resources by, for example, providing employees with assistance to self-directed career development even as we help them stay aligned on the same vector. We will also promote diversity and inclusion. Through these and other initiatives, we will accelerate the Group’s growth as a global corporation.

With regard to financial strategy, we will balance the pursuit of growth investment and the maintenance of financial soundness in a manner that remains conscious of capital efficiency. Simultaneously, we will strengthen our ability to generate cash returns to enhance ROE while promoting ESG management. We will strive to raise our corporate value through synergies arising from these pursuits. As for shareholder returns, we will stay committed to our policy of pursuing the medium-term average dividend payout ratio of at least 40%. Moreover, we aim to further strive for the stabilization of shareholder returns and, to this end, have set a minimum of ¥110 for annual dividends per share. We will also take a flexible approach to repurchases of Company stock to enhance shareholder value.

Policies and Strategies by Business Model

《Built-to-Order Business》

In the detached houses business, we will deepen our three-brand strategy aligned with each price range, with the aim of enhancing our brands. We will also evolve and integrate technologies, lifestyle design and services while promoting our Customer Relationship Management (CRM) strategy to pursue customers’ happiness.

In the rental housing and commercial buildings business, we will strengthen and thoroughly implement area marketing while promoting the supply of high-value-added properties, such as ZEH. By doing so, we will enhance the Sha Maison brand. We will also step up ESG solution proposals as we push ahead with operations related to Corporate Real Estate (CRE) and Public Real Estate (PRE).

In the architectural/civil engineering business, we will leverage Konoike Construction’s strengths in eco-friendly measures and technical capabilities. With these strengths as drivers, we will reinforce our environmental solutions in the civil engineering field while expanding and deepening our channels for securing orders in the architectural field.

《Supplied Housing Business》

In the rental housing management business, we will deliver a diverse lineup of solutions to owners of rental housing and strengthen relationships with them, with the aim of maximizing the asset value of rental properties. At the same time, we will step up services for residents to secure their satisfaction and enhance the Sha Maison brand.

In the remodeling business, we will provide timely and optimal proposals regarding remodeling based on insights we draw from our housing stock database, leveraging our track record in supplying a cumulative total of 2.5 million units. Even as we strengthen proposals on environment-based remodeling for detached houses, we will promote renovation for rental housing to improve its asset value.

《Development Business》

We will thoroughly implement area marketing while promoting this business based on investment judgment employing a medium- to long-term perspective that is conscious of asset efficiency.

In the real estate and brokerage business, we will develop beautiful residential land with high asset value. We will also develop the surrounding green environment while facilitating and invigorating the circulation of existing houses. In the condominiums business and the urban redevelopment business, we will strive to supply properties with high asset value, to this end taking a strictly selective approach to identify target areas from among those in four main metro areas. We will also promote the development of ZEH condominiums and ZEB. Furthermore, we will contribute to regional revitalization through collaboration with municipalities and other bodies by, for example, implementing the “Trip Base” Michi-no-eki Stations Project.

《Overseas Business》

We will strengthen collaboration with existing partners to push ahead with market development while transferring Sekisui House technologies cultivated in Japan and promoting our own SHAWOOD brand. Simultaneously, we will continue to implement proactive growth strategies for the homebuilding business, with the goal of annually supplying 10,000 housing units in the United States, Australia and the United Kingdom. In the United States, we will also explore opportunities to expand into untouched market areas, such as the southeastern region, with an eye to further expanding our local operations.