For current and potential shareholders

Growth Strategies

What are your growth strategies moving forward?

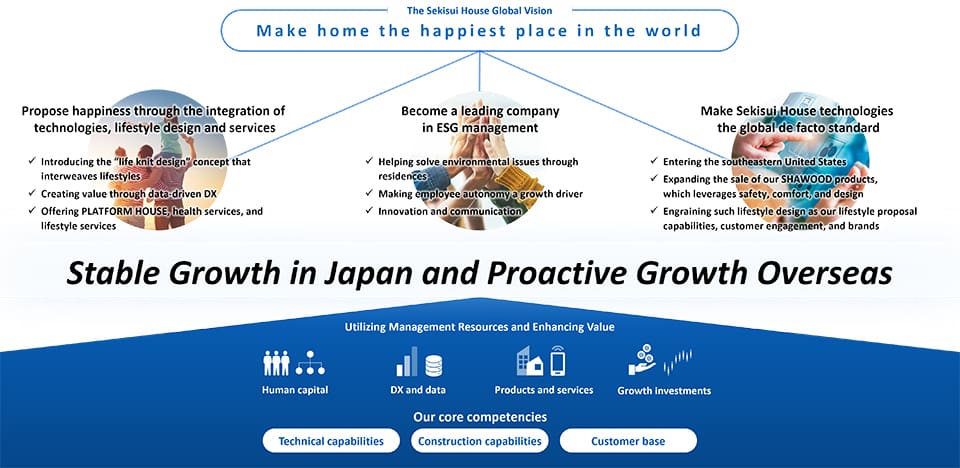

- We designated “make home the happiest place in the world” as our global vision, working to grow into a global company that leverages the core competencies developed since our founding and offers integrated technologies, lifestyle design and services based on the residential domain.

-

Based on our fundamental policy under the Sixth Mid-Term Management Plan, “growth in Japan and proactive growth overseas,” we are implementing growth strategies both in Japan and overseas. Specifically, the Group will strive to deepen and expand its existing businesses by taking full advantage of its core competencies, namely, technical capabilities, construction capabilities and the customer base, and by leveraging its unique value chain, supported by Sekisui House Group companies that together handle the entirety of housing construction processes.

At the same time, by transferring Sekisui House technologies cultivated in Japan to pursue business development overseas, addressing changes in society and the business environment and leveraging digital technologies, we will develop and expand new businesses.

Value Creation Process

Beginning with the FY2021, Sekisui House publishes Value Report (Integrated Report) that incorporates our conventional Integrated Report and Sustainability Report.

Initiatives in new businesses

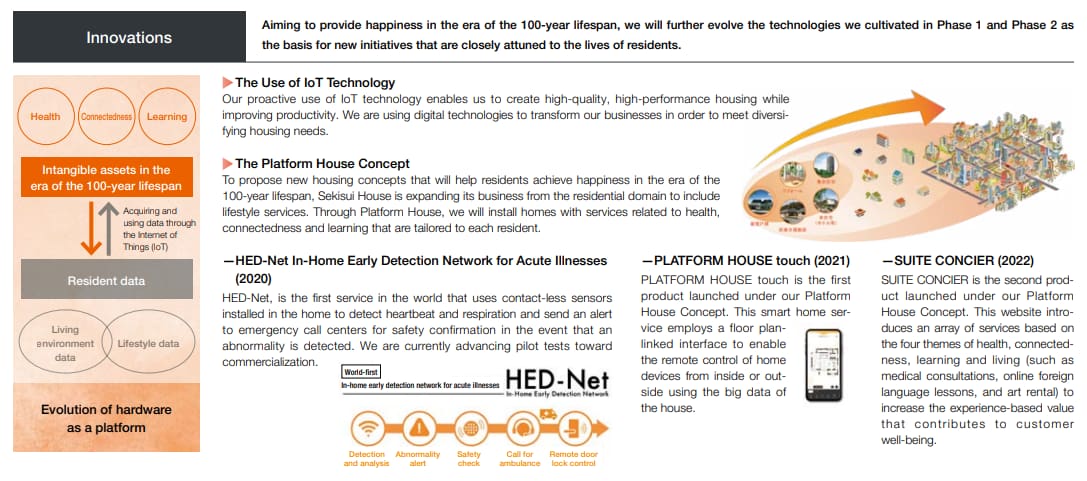

The Platform House Concept

To propose new housing concepts that will help residents achieve happiness in the era of the 100-year lifespan, Sekisui House is expanding its business from the residential domain to include lifestyle services.

Through Platform House, we will install homes with services related to health, connectedness and learning that are tailored to each resident.

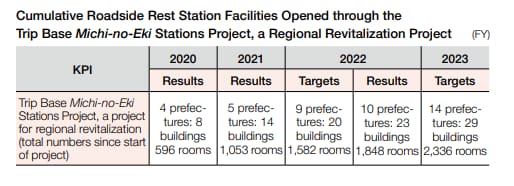

Regional Revitalization Business: The Trip Base Michi-no-Eki Stations Project

The Trip Base Michi-no-Eki Stations Project, a regional revitalization project that we are developing with Marriott International, proposes a style of travel that encourages the exploration of lesser-known destinations to discover their unique charms through a system of roadside rest stations known as “Michi-no-Eki.”

The project operates Fairfield by Marriott roadside hotels specializing in overnight stays. With the aim of promoting the use of local stores and other facilities, the project is deepening collaborations with local communities and alliance partners.

To help solve local issues and revitalize local communities, the project has realized a series of initiatives.Aiming to expand the number of rooms to roughly 3,000 nationwide, we will continue to contribute to regional revitalization by promoting tourism.

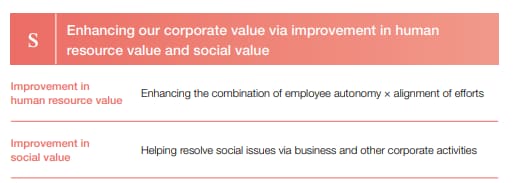

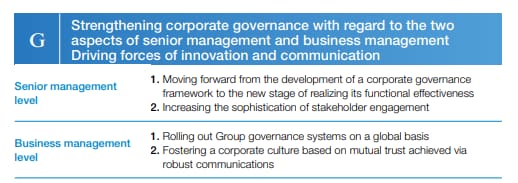

ESG Strategies

As a leading company in ESG management, based on our fundamental policies of helping resolve environmental issues through residences, making employee autonomy a growth driver, and innovation and communication, we will further enhance ESG management centered on our material issues.

Same time, to develop human resources who internalize and take ownership of ESG and think and act autonomously, we will advance ESG management that involves all employees, an approach unique to the Sekisui House Group.

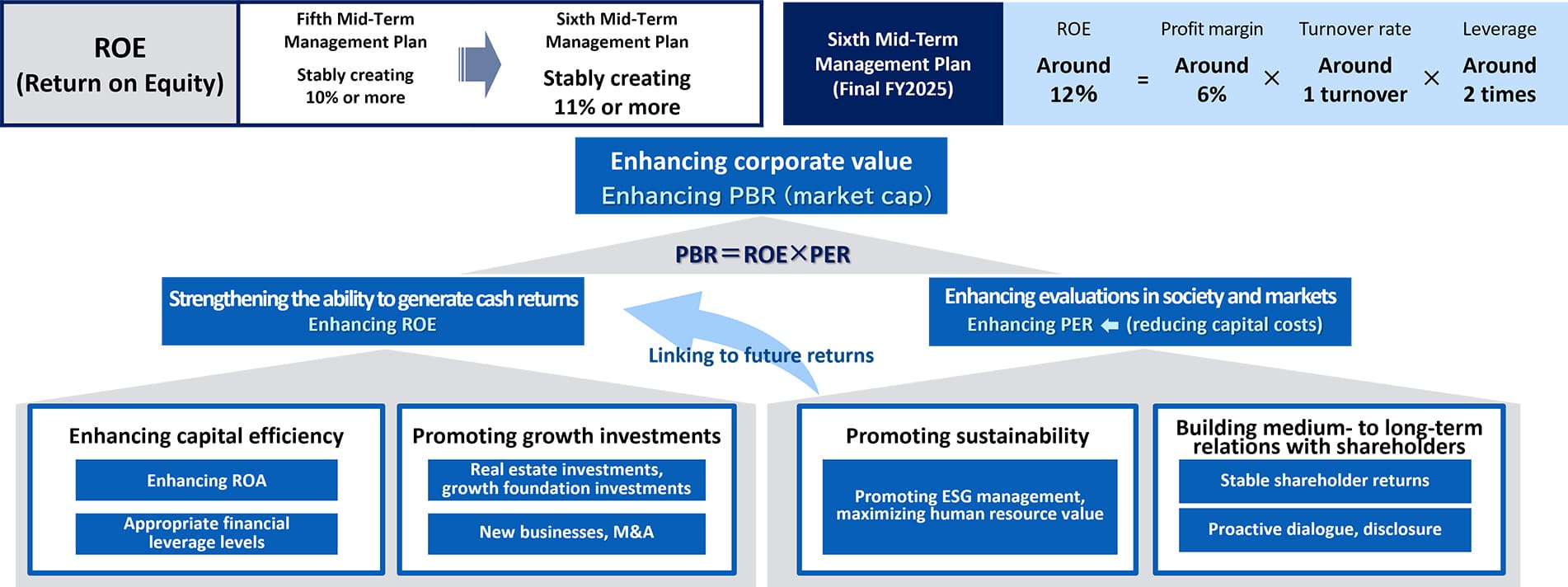

Financial Strategy

We aim for sustainable improvement in ROE by strengthening our ability to create cash returns through the enhancement of capital efficiency and the promotion of growth investments.

We also work to reduce capital costs through the further promotion of ESG management, and because of that we enhance corporate value through the reciprocal effects of enhancing ROE and promoting ESG management.